Establishing secure connection…Loading editor…Preparing document…

We are not affiliated with any brand or entity on this form.

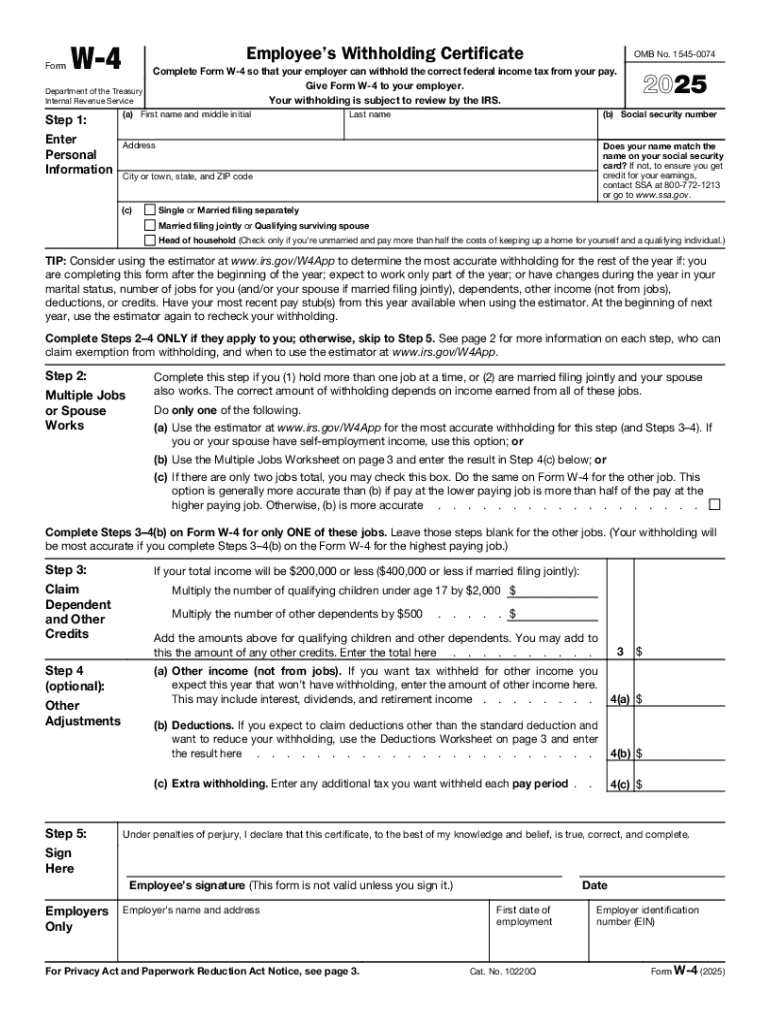

Form W 4 Employee's Withholding Certificate

be ready to get more

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Form W 4 Employee's Withholding Certificate

Instructions and help about Form W 4 Employee's Withholding Certificate

Create this form in 5 minutes!

How to create an eSignature for the form w 4 employees withholding certificate 771302722

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What should you do with the employee's withholding allowance certificate after you fill it out?

After the employee completes and signs the Form W-4, you must keep it in your records for at least 4 years (see Publication 15 and Topic no. 305, Recordkeeping).

-

What does Form W-4 employee's withholding allowance certificate mean?

Form W-4 tells you the employee's filing status, multiple jobs adjustments, amount of credits, amount of other income, amount of deductions, and any additional amount to withhold from each paycheck to use to compute the amount of federal income tax to deduct and withhold from the employee's pay.

-

Is it better to choose 0 or 1 on W4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

-

How do I fill out an employee withhold certificate?

Here's a five-step guide on how to fill out your W-4. Step 1: Enter your personal information. ... Step 2: Account for all jobs or spousal income. ... Step 3: Claim dependents, including children. ... Step 4: Refine your withholdings. ... Step 5: Sign and date your W-4.

-

How do I file an employee withholding?

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

-

What do I put on my employee's withholding exemption certificate?

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax.

-

Who completes the employee's withholding certificate?

While the employee completes the W-4, the information provided on the form is primarily used by the employer as a basis for payroll calculations throughout the employee's term of employment.

-

What is a withholding certificate?

A withholding certificate is required when people want to claim exemptions from withholding the tax on the U.S source income. Moreover, people who want to inform about their foreign or U.S status to the withholding agents also file Withholding Certificate Forms.

Get more for Form W 4 Employee's Withholding Certificate

- 65935 massachusetts mutual life insurance company original filing separate accounts sepa original filing form

- F5286 dollarcostaveragingrequest form0511final doc

- Current prior form

- Newly hired experienced miner training program b after each form

- Federal cash transactions report code 210 form

- Acknowledgement of requirement to submit healthlife insurance form

- Resource name or 149 moffett federal aireld p1 other identifier form

- Alaska ak vital recordsstate certificates form

Find out other Form W 4 Employee's Withholding Certificate

- eSignature Ohio Legal Last Will And Testament Computer

- eSignature Indiana Lawers IOU Fast

- eSignature Indiana Lawers IOU Simple

- eSignature Ohio Legal Last Will And Testament Mobile

- eSignature Indiana Lawers IOU Easy

- eSignature Ohio Legal IOU Easy

- eSignature Indiana Lawers IOU Safe

- eSignature Ohio Legal Last Will And Testament Now

- eSignature Ohio Legal IOU Safe

- How To eSignature Indiana Lawers IOU

- eSignature Ohio Legal Last Will And Testament Later

- How Do I eSignature Indiana Lawers IOU

- Help Me With eSignature Indiana Lawers IOU

- eSignature Ohio Legal Last Will And Testament Myself

- How Can I eSignature Indiana Lawers IOU

- Can I eSignature Indiana Lawers IOU

- eSignature Ohio Legal Last Will And Testament Free

- eSignature Ohio Legal Last Will And Testament Secure

- How To eSignature Ohio Legal Last Will And Testament

- How Do I eSignature Ohio Legal Last Will And Testament

be ready to get more

Get this form now!

If you believe that this page should be taken down, please follow our DMCA take down process here.